Nexus Score

Aclaró’s Nexus Score helps auto lenders calculate risk factor for their borrowers.

Nexus Score

Imagine being able to see the information over 10,000 US banks and using that to see what a borrower’s financial health is. Of course, this allows your salespeople to be able to see how much car someone can afford, how hard it will be to get them a loan, and how easy it will be to sell them into a great vehicle.

This type of information delivers leads to your dealerships and to lenders.

Of course, you know that lenders are a vital part of your business. If your lenders find prospects, you can easily turn those people into buyers on your auto lot. Your lenders can see what leads in their portfolio are strong. That’s information that you can use as well.

It’s a powerful tool for finding the right prospects. As an auto dealer, you can find leads that are prequalified to purchase a vehicle.

Using TrueView, you’re able to manage your entire loan portfolio, keeping track of the health of this important asset in real time.

See where you’re riskiest loans are and where the safest loans are. This can deliver a great new revenue stream where you can make money by making loans to your customers.

Our Products

The intuitive TrueView dashboard delivers lots of data:

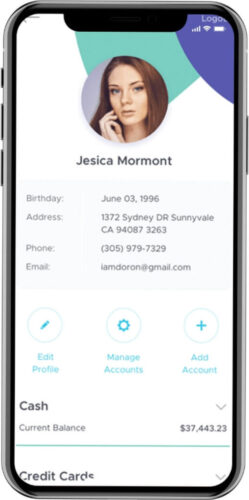

Nano Profile

Using our tools, Nexus Score and Nano Profile, you’re able to combine information about a prospects life, like major life changes, with their financial health. This can deliver a complete lead profile that will help you sell them just the right vehicle at just the right time.

EngageMe

EngageMe is our survey software that asks consumers what they want even before their sure. Combining the answers from EngageMe and Nexus Score, the leads will tell you what they want and you’ll be able to see what they can honestly afford.

TrueView

TrueView is a loan portfolio management software. Using this information, your dealership is able to see how well you’re doing finding great prospects, people who can afford the vehicles you’re selling