Menu

TrueView

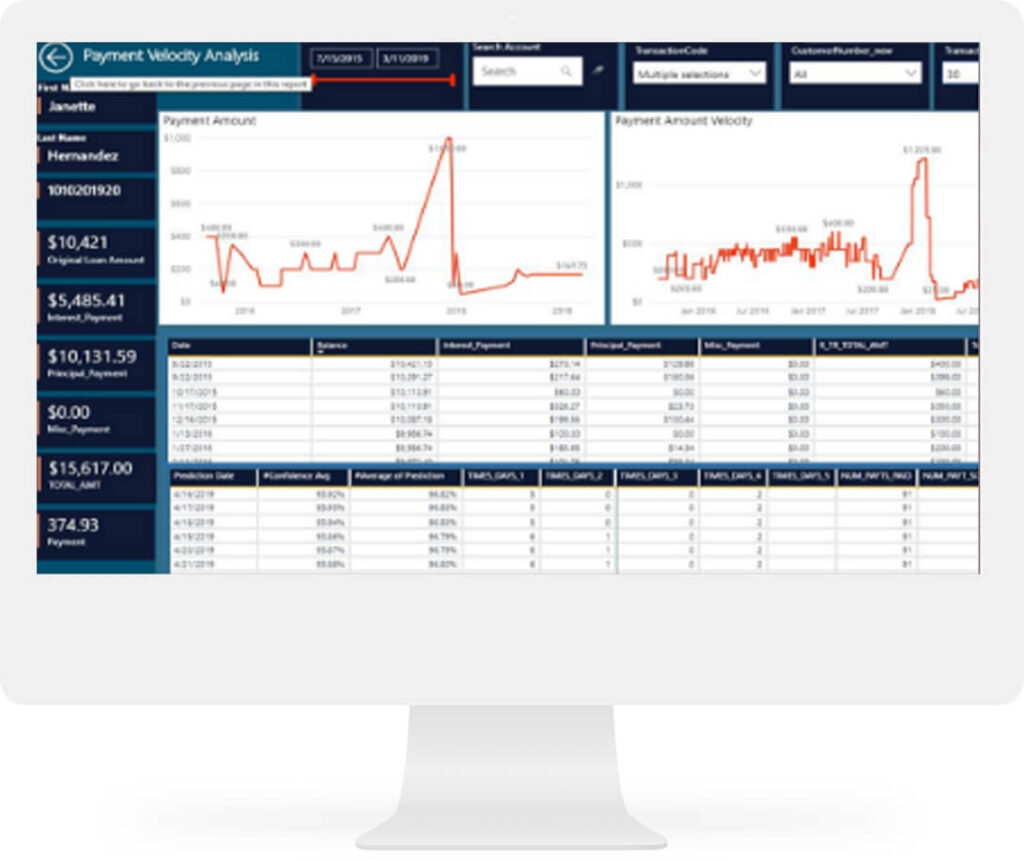

TrueView Loan Default Risk Management.

Artificial intelligence gives you the power to see how the loans you’ve made are fairing, whether they’re financed by someone else or directly.

A New Revenue Stream

One of the reasons that many auto dealerships don’t get into lending is because they don’t have the resources to manage their loan portfolio.

Using TrueView, you’re able to manage your entire loan portfolio, keeping track of the health of this important asset in real time.

See where you’re riskiest loans are and where the safest loans are. This can deliver a great new revenue stream where you can make money by making loans to your customers.

What does TrueView track?

The intuitive TrueView dashboard delivers lots of data:

- Credit terms

- Insurance coverage

- Employment information

- Vehicle data

What does TrueView deliver?

Peace of mind! TrueView is able to deliver clients with a 97% likelihood of paying off their loans. That means that nearly 100% of the loans that TrueView recommends will be paid off on time or early.

Should you loan money?

If your dealership has the cash to loan money, you can make a great deal of profit from it. In fact, huge corporations like GM make the bulk of their money not from auto sales, but from lending money to buy those vehicles.

TrueView and the Aclaró Suite of Solutions

From the marketing power of EngageMe to the granular information of Nano Profile, the Aclaró suite is designed to work together seamlessly to deliver profits and success.

We cover your from the moment that you start your marketing to the day that you collect the very last payment on the sale.